After the stress of March 2020 and around 50-60 days of containment, the financial markets have stabilized thanks to the historic injections of liquidity by the central banks of most countries, while waiting to see more clearly.

Today the performance of the main indices between January 1, 2020 and May 18:

- Cac 40 : -26.8%

- Sp500: -11.4%

- DAx : -18.7%

- Nasdaq : +0.5%

- SP500 VIX : + 123 %

Compare with the last articles of March 06, 2020: https://omal.lu/point-sur-la-situation-au-06-mars-coronavirus/

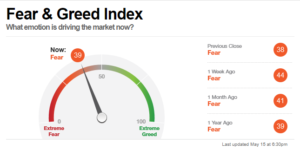

CNN’s Fear and Greed Index measures fear and risk appetite. This answers a question: « What is the predominant emotion of the stock market right now? »

This is a sentiment indicator if the stocks are undervalued or overvalued. The logic behind this is that too much risk appetite can push stocks beyond their “fair price” and that too much fear pushes stocks below their intrinsic price. Because investors are acting rationally in the very short term.

The level of confidence has risen well, but remains in a zone of worries and risks linked to the financial markets, divided between a declared power of the central banks and the reality of the economic situation which is likely to explode again.

Although central bank interventions have eased the stresses related to market liquidity. Few problems are solved economically:

The first bankruptcies linked to quarantines and the first backup plans through mass layoffs. (“Emirates could cut up to 30,000 of its 105,000 jobs, according to information obtained by the agency Bloomberg, and plans to « Accelerate the withdrawal of Airbus A380s from its fleet. Air Canada will reduce its 38,000 jobs by up to 60%. »

https://www.bfmtv.com/economie/coronavirus-uber-licencie-3500-personnes-par-visioconference-1915671.html

US-China trade tensions increasing day by day

Trade war increases, the United States (like other countries) threatens China with economic sanctions which also responds with protectionist measures

https://www.businessinsider.fr/us/the-us-china-entering-new-cold-war-amid-coronavirus-2020-5

Tensions in Europe :

Germany wishes to sue the European Central Bank for its monetary policy, the court of European Justist immediately governs and threatens Germany with further prosecution …

Course changes :

Many elements will change with the Virus and it may well be that in return for financial aid from the state, the companies concerned must respect commitments in terms of ecology and environment. The automotive sector will surely have to accelerate its change to the electric car, driven by financial aid.

Summary of the intervention by POwell (director of the FED) on May 18

Oil returns above $ 30 per barrel

The consequences of a sharp economic downturn are beginning to be felt, to follow how societies will adapt and organize themselves to weather the storm …

The purpose of this article is to synthesize the most important elements in order to have an overview.

No comments on the dangerousness of the Virus nor advice of purchase or sale.

In a period like this, stay informed Optimum Market Analysis Luxembourg will make several articles when more precise information is present.

Related sources and articles:

https://www.businessinsider.fr/us/the-us-china-entering-new-cold-war-amid-coronavirus-2020-5