In this article Capitelia will present to you her choices made in 2019 and 2020. None buying or selling advice. This will be a presentation of the strategies and why they were chosen

Summary of performances and index 2019/2020:

- 2019: CAC 40 + 26%, this year 2019 Capitelia had average returns around 10% which is much lower than the world indices but the strategy was to protect the portfolios very early in the year around July / August. The the increase at the end of 2019 therefore impacted the performance of assets under management.

- 2020: Cac 40 – 36%: Since the beginning of the year, the portfolios in management of Capitelia are positive and have an average yield of around + 8%. Which allows on average to be, between start 2019 and mid-March 2020, around + 40% on the indices.

Articles and facts from 2019 that explain the 2019 strategy, articles from Optimum Market Analysis Luxembourg that allow you to have a detailed and accessible vision of the situation without buying and selling advice.

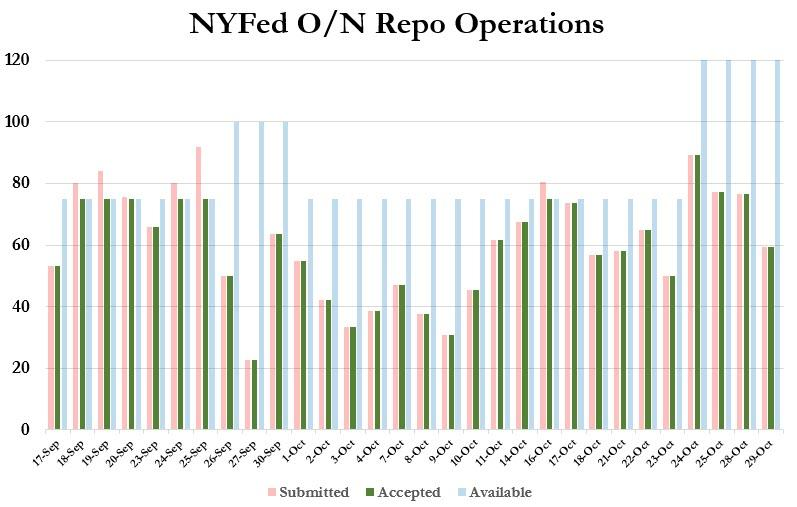

– Repo Rate Article: from September 16, 2019: https://omal.lu/le-repo/

– Repo Rate article following November 06, 2019 : https://omal.lu/le-taux-repo-suite/

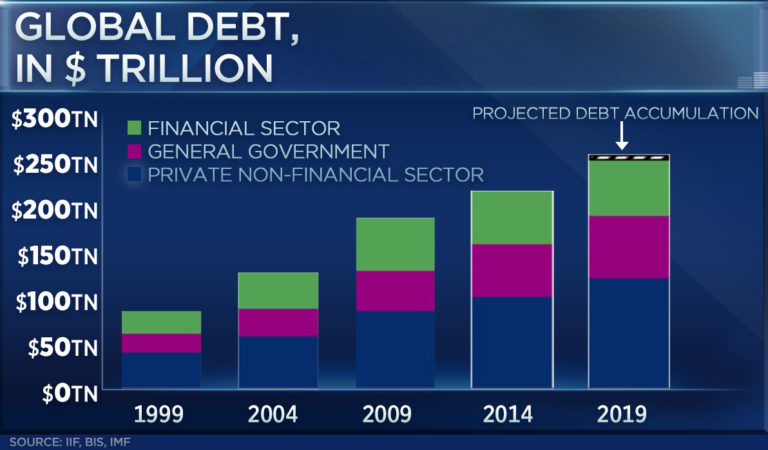

– Negative interest rates, what’s going on? : https://omal.lu/taux-interet-negatifs-que-se-passe-t-il/

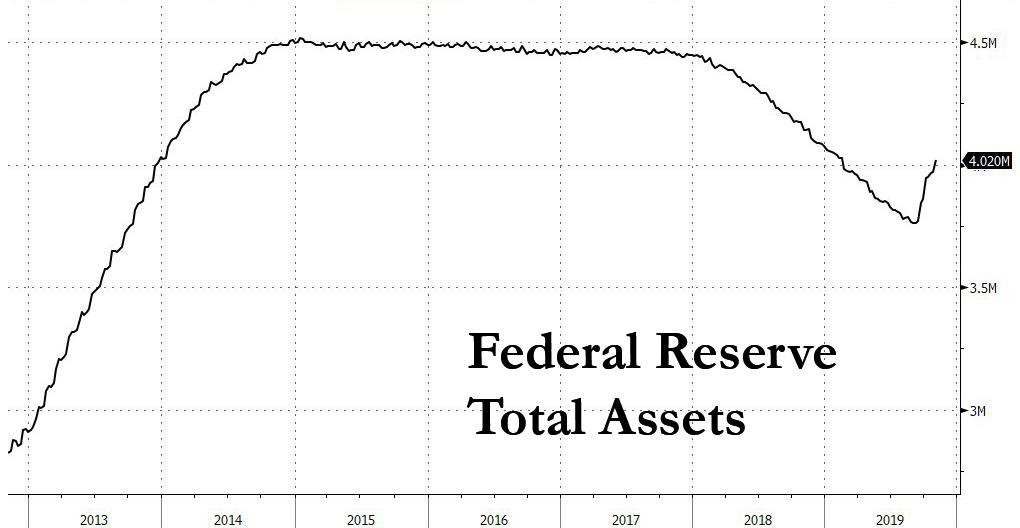

-Liquidity and financial markets: https://omal.lu/liquidites-et-marches-financiers/

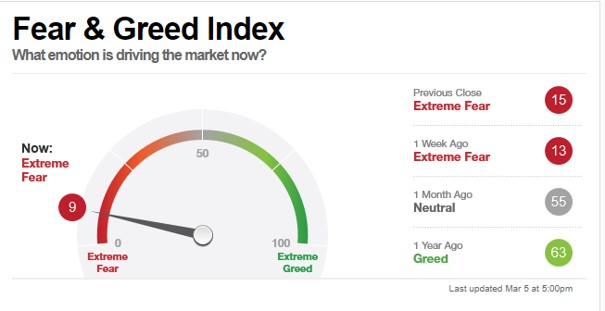

-Update on the situation on 06 March / Coronavirus : https://omal.lu/point-sur-la-situation-au-06-mars-coronavirus/

After analyzing the situation in China on the Coronavirus, Capitelia has sold its Luxury / Oil and Oil services values / Automotive / Gold and Silver Raw Materials. Mainly informed live on Twitter with translation of Chinese websites and other Asian caregivers.

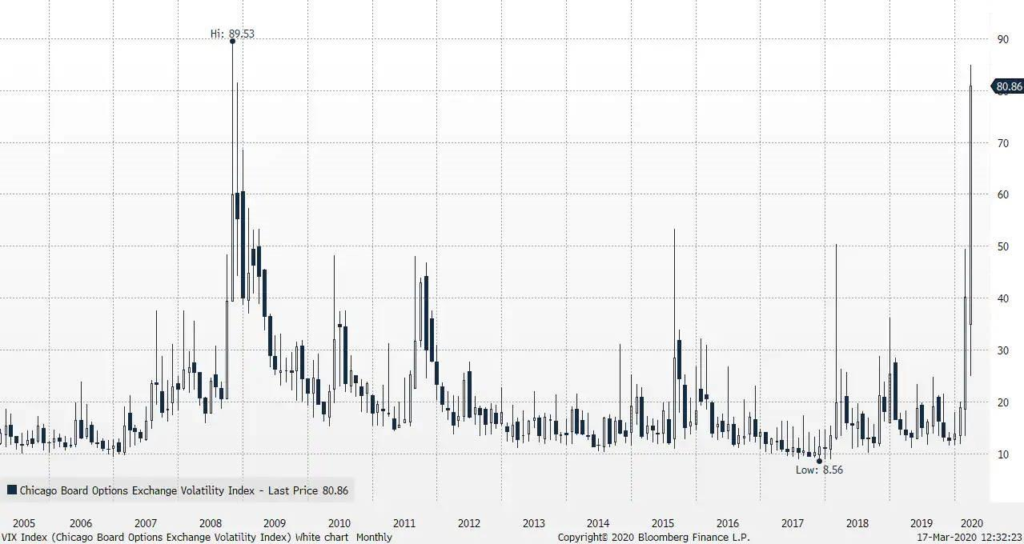

Gradually the portfolios are found before the February 21 crash, with between 35% and 40% / * 30% shares / 20% protections (10% VIX, 5% BX4 and 5% eurotstoxx / 10% funds and commodities.

Vix has reached its highest in more than 10 years approaching 2008, stress and volatility reaching their peak Of the history.

The product chosen by Capitelia is TVIX (US22542D2586) which is the derivative of the volatility product issued by Credit Suisse. He passed from $ 39 on February 19 to $ 550 on March 16, 2020. Zone where Capitelia sold the most of its product positions. Because the systemic risk and counterpart on this type of product becomes, in these times of crisis, more risky as possible gain. In an article on the Repo rate (September 18, 2019) Capitelia exhibited the TVIX product there and a reflection on the reasons for being interested.

After selling some of the protections that were overweight. The portfolios managed by Capitelia are now at 50% Cash / 10% protection and 30% equities (very nice opportunities in many industries are present) / as well as 10% of funds and raw materials including coffee, (Cocoa and sugar had been sold at the start of the crisis in anticipation of falling demand)

The silver raw material becomes one of most interesting raw materials and an article will be devoted to it soon, because this asset is highly undervalued.

Monetary injections :

- Repo rate: 5 trillion to calm the liquidity market

Direct market injections:https://www.lemonde.fr/economie/article/2020/03/19/coronavirus-la-banque-centrale-europeenne-lance-un-plan-d-urgence-historique-pour-calmer-les-marches_6033613_3234.html

Global rates drop between 0.5% AND 1% for the moment. An article below groups together some of its measures